FDI in Retail - The Charade Goes On....

see previous

Somewhat Blurred Vision?

The Prime Minister, Mr. Manmohan Singh, in his address at the Indian Economic Summit on 29.11.05, said of FDI in general and FDI in Retail in particular:

“I have often heard complaints from many corners that we have not made progress in our FDI policy. In fact, my own assessment is that today, we have one of the most liberal FDI regimes in the world. We have unshackled FDI policies in telecom, publishing, real estate and in asset reconstruction firms in the last couple of months. The troublesome Press Note 18 has been done away with. Barring the financial, retailing and coal mining sectors, we are extremely liberal in welcoming FDI. There is a Group of Ministers, which is examining ways of rationalising the current FDI regime so that there is less red tape. Sometimes, I do recognize our ability to create bureaucratic hurdles in the way of enterprise amazes me. I think that as far as FDI is concerned, it is not policy but badly designed procedures and poor infrastructure, which are today the most important constraint. As for FDI in retail, we are engaged in an intellectually stimulating exercise to understand the possibilities that exist in opening up this sector and how best we can harness it for our needs.”

A few days earlier, his pilot for Operation “Thrust Retail FDI”, Mr. Kamal Nath, had this to say at the Economic Editors’ Conference:

"We are in agreement with Left parties that FDI should not replace or displace jobs. We are yet to evolve a model....the main problem is between large and small players and not domestic versus FDI.” He further said that on final count, the whole discussion on FDI in retail centred round one major issue, that of big retailers displacing the small retailers, saying: "It makes no difference whether the investment is domestic or foreign. The debate now is big versus small and not FDI versus small `kirana' stores. The idea is to see that small shopkeepers do not get displaced and employment is generated"

On 19.11.05, in the Parliamentary Consultative Committee of the Ministry of Commerce and Industry, he explained that the issue of FDI in retail was not that of Foreign versus Domestic, but essentially of the Big versus the Small, adding that the right model for India was yet to be evolved and the whole issue was under discussion.

Some days prior to that he had said:

"We are examining FDI in retail. We are keen to see that retail leads to modernization of our agriculture. The challenge is to find a model which does not displace or replace the existing investment and small shopkeepers". He said the model that the Government was looking at must bring technology and not replace existing investment. Stating that the interests of the small grocery owners must be safeguarded not by the "colour of money" alone, the Minister said if this argument was to be accepted, the small-time shop owners would also be hurt by the emerging super marts being put up by the large domestic retail houses. In this regard, he underlined the urgent need to step up investment in food processing and foster backward linkages, including marketing, particularly when 40 per cent of the fruit and vegetable produced in the country rotted every year for lack of modern preservation technology, including cold chains. That is why the Government was looking into different models of FDI in retail and was open to one that would not displace existing employment in this sector. The Minister conceded that there were problems in free movement of agricultural products within the country and this should be addressed before any FDI model for retail trade was put in place.

Echoing positive sentiments on the subject, Mr. Chidambaram, the Finance Minister said at the Indian Economic Summit, that:

“So far as FDI in Retail goes, the only way we can move is through a public debate, which is going on. I expect that the Commerce Ministry will be able to arrive at a decision which is acceptable to all in three to four months.”

He also sought to link the issue of FDI in Retail with the larger issue of attracting FDI into the country to achieve growth rate of 8% in GDP.

At the time of the 58th AGM of Assocham, the Deputy Chairman of Planning Commission, Mr. M.Ahluwalia said:

"We are looking into the pros and cons to allow FDI in retail. Internal discussions are on. I think the paper should be ready next year," and "I do not want to give a definite time. But we want an early resolution of the matter. We have said that FDI should be allowed in retail in the MTA of the Tenth Plan,"

These comments coming from those in a position of authority within a short time, are mentioned to show that the Government is hell-bent on rushing to FDI in Retail at any cost, having discovered FDI in Retail as THE panacea for all the problems of development affecting the country.

However, this rather disproportionate emphasis on FDI in Retail only tends to distract from the issue of real and major concern, which the Prime Minister’s own speech above has indicated.

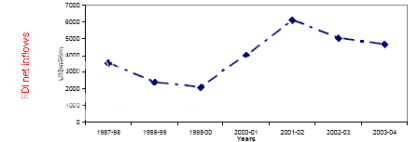

At the core of the debate on FDI at the macro level is the failure of the Government in attracting FDI in key areas, as already highlighted in earlier articles. By the Prime Minister’s own contention in his speech above, the country has one of the most liberal FDI regimes in the world today. The Finance Minister too had a point when he cited the example of China in attracting FDI. But as all concerned with the subject within the Government must know, China’s success lies not merely in attracting high levels of FDI but also in attracting it in the right areas. China started on the FDI path in 1979 and between then and 2004, it contracted FDI amounting to US$ 1094.94 billion. Out of this, as much as US$ 1062.58 billion was contracted between 1990 and 2004 and the amount utilized was US$ 544.82 billion. Even during 2005 (January-July), China contracted for FDI amounting to US $ 98.64 billion and utilized US$ 33.09 billion. Even considering that a significant amount is being reflected as FDI due to round tripping, the figures are enormous, when compared with our optimistic projections of US$ 8 billion for this year. In the years in which China had enormous inflows, Retail was NOT the sector that brought FDI inflows to an appreciable extent. (See article).

If the Government really intends to carry out an ‘intellectually stimulating exercise’, the same should be concerned with looking into the reasons for its inability to garner FDI for manufacturing and infrastructure and the consequences of continuing failure to make any headway in this direction, rather than emphasising on the Retail sector and trying to turn development economics on its head. Once the reasons for the small flow of FDI are examined in depth, our shortcomings in critical areas, too well known as they are, will come to the fore. For example, at a Conference on 24th November 2004 on Improving Investment Climate, the World Bank, an external agency that we like to listen to carefully, listed four key areas that are proving to be a roadblock to progress. These are: Infrastructure, bureaucracy, labour markets and access to finance by SMEs. (See)

The other aspect relating to FDI at the macro level is that the Government’s approach has been less than purposeful so far. Its half-hearted actions emphasizing different sectors at different times and trying to simply push for higher ownership limits for foreign investors in one sector or the other do not inspire enough confidence. There appear to be no sector-wise priorities or overall road map, as evident from the way the emphasis has shifted to Retail sector from more critical sectors, like clutching at straws. It is not known if any targets for FDI in critical areas have been set and the bottom line seems to be simply to ‘get whatever maximum we can’.

On with the Retail Charade…

For the present, however, the Government’s energies are primarily concentrated in proving the case for FDI in Retail despite strong objection from different stakeholders. In pushing its case, the Government does not seem to think much of the valid and cogent arguments put forward by the Left parties recently supporting its consistent opposition.

External Pressures and Lobbying

Walmart's Menzer

Apart from the inability to secure FDI where needed, the other unstated impetus for the urgency is apparently the tremendous pressure from foreign governments and International agencies like World Bank and strong lobbying by multinational Retailers. The U.S. in particular, has been turning on the heat for quite some time, the latest gratuitous message having been delivered on 8th November by US Treasury Secretary John Snow. Even the British Government is now taking up the case for allowing FDI in Retail. "We are all lobbying like mad," said Sir Michael Arthur, high commissioner at the British High Commission in New Delhi, speaking in Bangalore on 15.11.05. He further said, "It's a hot topic in Delhi this autumn,” The British Government is supporting the attempt of TESCO, the major UK Retailer to enter the Indian market. At the same time, Tesco’s Chief Executive too urged the government to allow foreign retailers majority ownership of Indian retail operations. Earlier in the year, John Menzer of Walmart also visited India to lobby hard for this purpose. Clever comments in the media by the multinational retailers are also designed to put further pressure. Example: “Foreign retailers, which have become increasingly exasperated with the government’s failure to announce a clear policy for the sector, said the call for further national debate was another thinly disguised delaying tactic that pandered to vested interests.” (Financial Times, London, 30.11.05) It is strange that these retailers who themselves have a vested interest brazenly describe attempts by domestic stakeholders who are vitally concerned, as ‘thinly disguised delaying tactic’. Another gem is found in this comment: “.. unless India allows FDI in retail it would not be even in the radar of potential investors.” the implication being that no other FDI of any kind would flow unless FDI in Retail is allowed!! Unfortunately, the actions of the Government seem to suggest that it goes along with this line of thinking. Read further: “If the door remains half shut, both India and those eager foreign investors will be frustrated.” Oh? The investors in Retail Trade will come whenever they are allowed, in the world’s most attractive market after China. There is no ‘now or never’ scenario as far as FDI in Retail is concerned. There is also a concerted push by academics and consultants of all kinds presenting the FDI in Retail prescription to developing countries, and particularly to India, the most important market for the developed world.

It is clear that the Indian Government is unable to withstand such sustained onslaught of high pressure lobbying and advice from various external sources to influence its policy direction. The decision to allow FDI in Retail seems to have been taken a year back. In the middle of the year, the Prime Minister, speaking to Financial Times said he hoped the sector would be opened by year-end. Thus, the decision is ‘on course’. The FT report also mentioned that the Prime Minister sees the liberalisation of this sector as a “test case of his ability to govern…” In fact, the announcement, which could have been made during his recent visit to USA, was apparently staved off only following cautioning by the Left Parties prior to the visit against an announcement.

But the temptation to tell the world is apparently too much. The Prime Minister, already anticipating the conclusion of a so-called ‘public debate’, has just announced on 12th December 2005 while attending the ASEAN meet that the UPA government expects a ‘positive outcome’ on FDI in Retail in 5-6 months.

Need for a Green Paper

Many of the concerns and issues related to allowing FDI in Retail at this stage of our development, have been dealt with in earlier articles. However, the latest posture and the line of arguments adopted by the Government to push through its plan appear to present a misleading picture. These are dealt with in a separate article that follows.

The main issue is that a decision even to allow FDI in Retail at all at this time, which is of crucial importance for millions, needs to be based on a transparent public debate. Although the Finance Minister has attempted to convey that the Government is conducting a public debate, the Deputy Chairman of the Planning Commission indicated that internal discussions are on. The debate on this subject has not gone beyond discussions with the vocal allies, speeches at a few seminars, pronouncements of government’s intent through the media, and some consultations with business interests that may not represent all those who may be affected. Even if the Government has been pursuing the matter for a year now, it cannot be said that a meaningful, objective and transparent debate has taken place. If nearly a year has gone by, the reason is that efforts have not been based on coherent objectives, cogent arguments or systematic approach.

What was required from the beginning and is now essential is that the Government should publish a Green Paper on the subject for a wider and proper public consultation and debate. The Green Paper should, inter alia, detail with complete clarity:

- The Objectives for allowing FDI in Retail at this point in time

- Estimate of FDI expected for this sector and the workings for the estimate, the assumptions and the formula for ownership that the Government has in mind upon which the estimate is worked out

- If the Objective is to secure vertical spillovers, in what manner and by what mechanisms would the Global Retailers be participating in backward linkages

- Other objectives, if any, which are a function specifically of FDI being allowed in Retail, i.e. they could not be achieved by other means, e.g. foreign participation in other ways or by domestic players

- Outcomes expected, Deliverables and quantification of benefits which are capable of being quantified, against the stated objectives

- The Pros and Cons to which consideration has been given by the Government

- Assessment of negative impacts, if any, on any stakeholders or a sector of the economy

- The alternative formulations and conditions being considered for FDI in Retail

- Details of policy initiatives necessary in other areas to realise the objectives of FDI in Retail

- Outflows related to the estimated FDI receipts by way of dividends, bonus share issues etc. over a period

A Government that claims to be transparent and willing to be accountable to the people should be ready to have a proper public debate on this policy issue as much as on other development issues.

see also previous

To be Contd….part II

3 Comments:

Your article is very interesting.

Being a indian university student from Montreal, Canada, i am increasingly interested in the affairs back home.

I thank you again.

Thanks to Niral for his kind comments.

The purpose of this site is to present an objective perspective on issues of current interest to people like him who can think constructively.

The disastrous WTO negotiations should awaken people to the harsh realities where the wealthy and the powerful call the shots.

Post a Comment

<< HOME